Combatting Turnover in the Financial Services Industry: Strategies for HR Leaders

Is your financial services company struggling to retain talent? Financial services institutions (FSIs) are notorious for high turnover rates as a result of workplace stress and burnout, with 82% of young finance professionals in the UK saying their job has negatively impacted their life. Luckily, HR leaders at FSIs don’t have to resign themselves to ongoing retention issues if they make the right strategic moves.

In this post, we’ll be covering:

- Why financial services companies struggle with employee retention.

- What HR leaders can do to keep employees engaged and productive.

- How HR automation can help finance companies hang on to top talent.

If your HR team is struggling to boost retention and wondering what to do about it, this post is for you.

Contributors to High Turnover Rates in the Financial Services Sector

The financial services sector is well known for operating at a frenetic pace and being extremely competitive. This can lead to a range of HR problems for FSIs that hinder your efforts to keep employees engaged and productive – new hires and established team members alike.

1. Employee Burnout

Employee burnout is a notorious problem in the financial services industry. Workloads tend to be mountainous, and it’s not uncommon for employees to work late into the evening to meet deadlines. In a Working Conditions Survey, first-year analysts at Goldman Sachs reported working 95-hour weeks and getting to sleep at 3 am on average.

2. Poor Work-Life Balance

Burnout is hardly the only negative result of the finance sector’s demand for long hours and high intensity. Employees’ work-life balance also tends to suffer. Retention difficulties stemming from poor work-life balance can be especially difficult to manage with senior-level finance employees. These roles often require extensive travel and high-stakes, hours-long negotiations, causing social isolation, extreme stress, and even health problems.

3. Low Engagement

Over time, the repetitive nature of many finance roles can erode employee engagement and make individuals feel disconnected from their jobs. This is a serious problem, because poor engagement can accelerate burnout and make key employees less productive, starting well before they leave your company.

Retention Strategies For HR Leaders in Financial Services

It’s no secret that banks, credit unions, and other FSIs are prone to high employee attrition rates. But as an HR leader, you have the ability to combat that trend. Below are some steps you can take to limit employee turnover at your organization. Don’t despair when faced with high turnover. Get proactive and creative instead.

1. Promote a Flexible, Possibly Hybrid Work Environment

Prioritizing work-life balance at your company can help you alleviate collective burnout by giving employees a way to better manage stress. This is especially true for women working in the finance industry, as women have been shown to value work-life balance even more than men.

HR leaders should consider opening up the possibility of remote work to individuals whose roles could be performed from home. Not only would this increase employees’ work-life balance by eliminating commutes, but a Deloitte survey indicates that overly strict in-office policies can fuel turnover while simultaneously making it harder to recruit new talent. So FSIs and their employees stand to benefit from remote or hybrid work arrangements.

2. Emphasize Career Development and Upskilling

Employees who feel they’re in a dead-end position with no room for growth are less likely to stay with a company long-term. If your FSI isn’t doing so already, taking steps to emphasize career development and upskilling for new roles can help you build a more engaged workforce.

When employees feel they have sufficient room for growth and are presented with development opportunities, they’re 15% more engaged on average, and have a 34% higher retention rate. Among German HR teams, on-the-job upskilling has been referred to as “learning in the flow of work,” and 62% of German employees say they’re motivated by development opportunities.

3. Build a Culture of Employee Recognition

Feeling unappreciated at work can have a detrimental effect on employees’ productivity, engagement, and even their overall mental health. According to a Gallup survey of 3,500 individuals, employees are 45% less likely to leave their place of work within two years if they feel recognized for their contributions.

Finance organizations are known for cultivating a high-intensity corporate culture. If HR leaders don’t go the extra mile to make employees feel seen and appreciated, FSIs can easily find themselves losing talent simply because they never stopped to recognize the accomplishments of their workers. Developing an employee recognition program that regularly spotlights the achievements of different team members can help you create a more supportive and appreciative environment.

4. Use Surveys to Guide Your Decision-Making

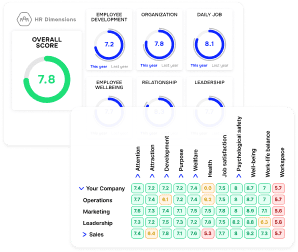

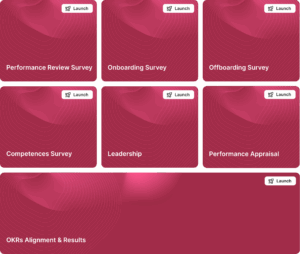

Sending out employee surveys can give FSIs valuable insight into their employees’ intention to remain with the company. However, HR teams often find themselves spending hours on manual survey analysis and struggling to translate survey results into concrete action. Software tools like atwork help HR teams make the most of their employee survey data and sidestep these common problems.

atwork can help FSIs run traditional surveys, but it’s also equipped with AI and natural language processing. This allows the software to analyze and summarize written employee survey responses and quantitative survey answers in seconds, giving HR teams an important source of real-time data.

It might take an HR team at a mid-size company several months to sift through employee survey responses, and a lot can change in that time. atwork gives you the ability to take the pulse on employee sentiment at all times, so you can spot and address retention risks immediately.

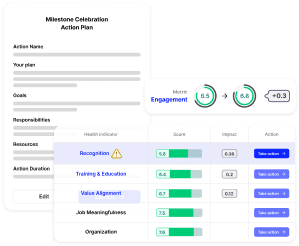

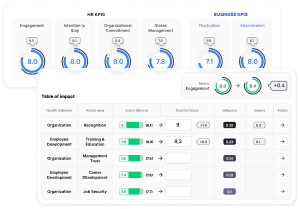

atwork also provides targeted action steps for improvement based on your KPIs, employee sentiment, and other key HR data that impacts employee retention. This process is fully automated, and the software considers your specific industry when formulating action plans, ensuring maximum effectiveness. Embracing an automated, data-driven approach to HR can help you combat the famously high turnover rates in the finance industry.

Boost Employee Retention With atwork

atwork is empowering FSIs to turn their HR data into impactful action plans that maximize employee retention. By leveraging automation in your HR department, your team can accomplish more with less time, effort, and money.

Contact us today to learn how atwork can help you boost employee retention at your financial services company.

You may also like

Engaged to Care: Transforming Swiss Hospital Workforces through AI and Strategy

Swiss hospitals are facing rising burnout, absenteeism, and disengagement among staff — but AI-powered tools could be the key to turning things around. This study, conducted by students at Lucerne University of Applied Sciences and Arts in collaboration with atwork, explores how strategic HR technology can help transform employee engagement in the healthcare sector.

Optimizing Employee Engagement through Modern Surveys

Equip yourself with the knowledge and tools to drive organizational success and create a thriving workplace culture.

How do you get meaningful results from employee surveys?

We all know what it’s like: you get surveys in your e-mail inbox, requesting you to evaluate a service or your own employer. The questions and answers you can select are often the same. So, most people just sign off. A low response rate is not only irritating. If the rate is too low, the […]

Guides

Guides  Studies

Studies